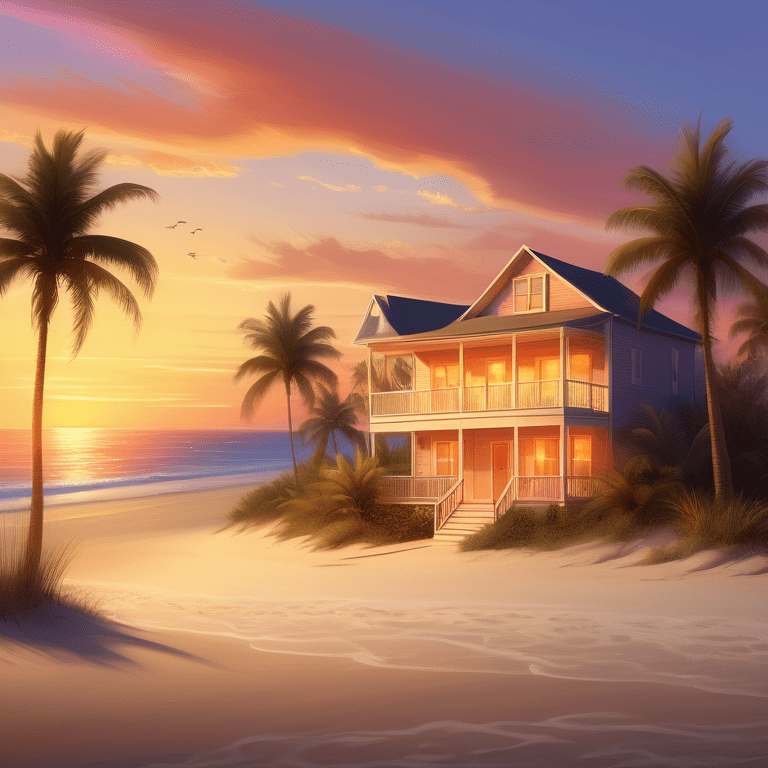

Many Ways To Sell

There are multiple ways to sell your home; however, authorizing away ownership that damages credit score, shames the family, and strips an owner of dignity is just one of the hardest. For proprietors who can no more manage to keep home mortgage repayments existing, there are choices to personal bankruptcy or foreclosure procedures. Among those alternatives is called a “Short Sale.”

The Bank

When lending institutions agree to make a short sale in real estate, it suggests the lending institution is accepting less than the entire amount due. Only some lenders will approve short deals or marked-down list prices, specifically if it would make even more economic sense to confiscate; additionally, only some sellers and some residential properties qualify for short sales.

There could be drawbacks if you are considering acquiring a short sale. For your defense, I recommend that all consumers:

* Acquire lawful suggestions from a competent property lawyer

* Call an accounting professional to discuss short sale tax ramifications

Although all lenders have varying demands and may require that a borrower submit a wide selection of documents, complying with the steps will give you a good concept of what to expect.

Call the Lending institution.

You may need to make six phone calls before discovering the person managing the short sales. Do not talk to the “real estate short sale” or “exercise” department, and you want the supervisor’s name, the name of the individual with the ability to decide.

Send a Letter of Permission

Lenders commonly wish to divulge all of your info with created consent. Suppose you work with a real estate representative, closing agent, title business, or attorney. In that case, you will undoubtedly get better participation if you create a letter to the loan provider giving the lending institution approval to speak with those certain interested parties concerning your car loan. The letter needs to consist of the following:

* Residential or commercial property Address

* Lending Referral Number

* Your Name

* The Day

* Your Representative’s Call & Get in touch with Details

Initial Net Sheet

It is an approximated closing statement that reveals the sales price you expect to obtain and all the expenses of sale, unsettled finance equilibriums, outstanding payments due, and late costs, consisting of real estate commissions if any. The closing agent or attorney should be able to prepare this for you if you cannot compute any of these charges. If the bottom line reveals cash to the seller, you will probably not need a brief sale.

Hardship Letter

The sadder, the better. This statement of realities explains how you entered this financial bind and pleases the lender to approve less than full settlement. Lenders are not inhumane and can comprehend if you lost your work, were hospitalized, or a vehicle ran over your entire family; however, lenders are not incredibly empathetic to circumstances involving deceit or criminal actions.

Evidence of Earnings and Properties

It is best to be sincere and truthful regarding your economic situation and disclose your possessions. Lenders will like to know if you have interest-bearing accounts, money market accounts, supplies or cash, negotiable instruments, bonds, or other real estate or anything of tangible worth. Lenders are not in the charity organization and typically call for assurance that the borrower cannot repay any flexible debt.

Duplicates of Financial Institution Statements

Suppose your financial institution statements reflect unaccountable down payments, significant money withdrawals, or an uncommon variety of checks. In that case, it’s most likely a great idea to clarify each line thing to the lending institution. On top of that, the loan provider may want you to represent every single deposit so it can figure out whether down payments will continue.

Comparative Market Evaluation

Occasionally markets decrease, and property values fall. It is part of the factor that you cannot offer your residence adequate to repay the loan provider; for the loan provider via a comparative market evaluation (C.M.A.). Your real estate representative can prepare a C.M.A. for you, which will reveal the costs of comparable residences:

* Energetic on the market

* Pending sales

* Sold from the past six months.

Purchase Contract & Listing Contract

When you reach an agreement to market with a prospective buyer, the loan provider will want a duplicate of the deal and a copy of your listing arrangement. Be prepared for the lending institution to renegotiate compensations and reject enabling settlement of particular things, such as residence defense plans or termite assessments.

conclusion

A short sale can be a viable option to get out of debt and save your credit from foreclosure. Contact us here at EPS Houses LLC to find out how we can assist you with available options to make an offer on your house. We have a variety of ways to purchase your home; a short sale is just one of those options.