Key Highlights

- Homestead property in Florida offers protection from creditors and tax.

- To claim the homestead exemption, need to file an with the county property appraiser and provide proof of ownership and residency.

- Homestead protection reduces taxes and provides asset.

- There are restrictions on the size and residency requirements for homestead protection.

- Selling homestead property requires careful consideration to protect the and ensure eligibility for exemption.

- Marketing and legal considerations are important selling homestead property Florida.

- 2.2: Introduction (150200 words)

- If you own a homestead property in Florida and are considering selling it, you may have questions about the process and how it may affect your homestead exemption and tax obligations. In this expert guide, we will provide you with all the information you need to navigate the sale of your homestead property successfully.

- Homestead property in Florida is not just any residential property; it comes with certain benefits and protections. Understanding these benefits and limitations is crucial when it comes to selling your homestead property. From the homestead exemption to property taxes and legal considerations, there are several factors to consider.

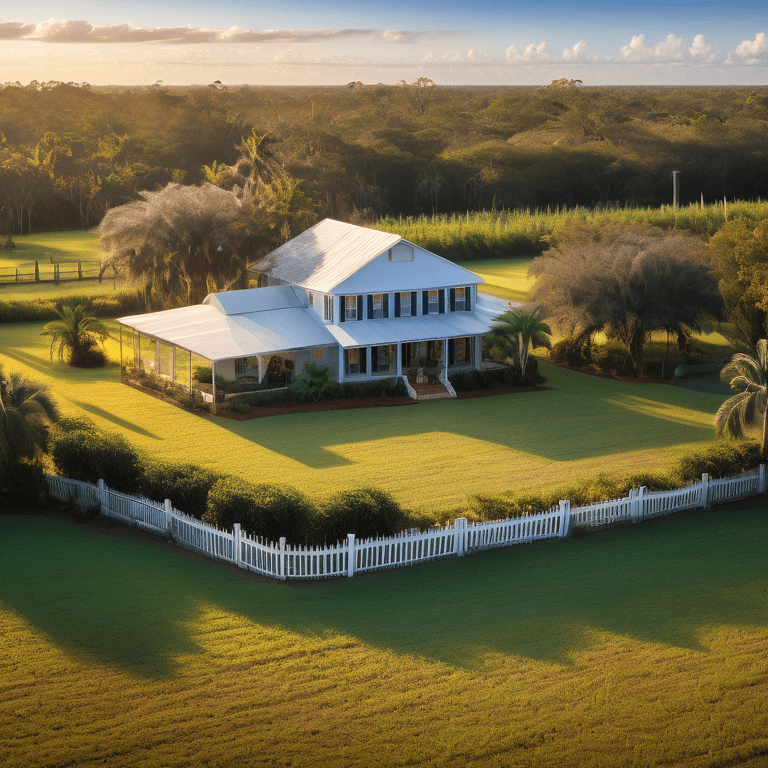

- To begin, let’s define what a homestead property is. In Florida, a homestead property is your primary residence, which can include various types of dwellings such as a house, condo, mobile home, or even a boat. However, certain criteria must be met. The property should be your permanent residence, and it should not exceed half an acre in a municipality or 160 acres outside a municipality.

- One of the key benefits of homestead property is the homestead exemption, which can help reduce your property taxes. It allows for a reduction in the taxable value of your property by up to $50,000. Additionally, if you have lived in your homestead property for at least two years, you may qualify for the Save Our Homes cap, which limits the annual increase in your property’s assessed value.

- Understanding the homestead protection laws in Florida is essential when it comes to selling your homestead property. By following the guidelines and making informed decisions, you can protect your assets and ensure a smooth sale process. In the following sections, we will delve deeper into the various aspects of selling homestead property in Florida, including legal considerations, preparing your property for sale, marketing strategies, and post-sale considerations.

Introduction

Selling Homestead Property in Florida requires a nuanced understanding of the state’s unique real estate landscape. Florida’s homestead laws, including the ruling by the Florida Supreme Court in JBK Assocs, Inc v. Sill Bros, Inc, play a crucial role in property transactions, impacting both sellers and buyers. Navigating this complex legal framework necessitates careful attention to detail and compliance with specifics such as tax implications and mandatory disclosures. This guide aims to provide a comprehensive overview of essential considerations when selling a homestead property in the Sunshine State, including the protection of proceeds from the sale under Florida’s homestead laws. With the help of these laws, homeowners can ensure that the proceeds from the sale of their homestead property are safeguarded, making it a valuable asset for future generations. Additionally, understanding and utilizing Florida’s homestead laws can provide peace of mind and financial security for families looking to sell their property, further highlighting the importance of Florida’s homestead laws in protecting homeowners’ assets.

Understanding Florida Homestead Laws

Florida has specific laws in place to protect homestead properties. These laws are outlined in the Florida Constitution and provide a level of protection against creditors and tax benefits for homeowners. To qualify for homestead protection, you must declare your property as your primary residence and meet certain residency requirements, including being a permanent Florida resident or having a valid visa. The declaration of domicile is a legal document that establishes your intent to make Florida your permanent home as a natural person or an LLC. It’s important to understand these laws and requirements, including the use of irrevocable trusts and the inclusion of separate legal descriptions, as outlined in the state constitution, to ensure you receive the full benefits of homestead protection in Florida.

The Basics of Homestead Protection in Florida

Homestead protection in Florida is designed to provide homeowners with certain rights and benefits. One of the main benefits is protection from creditors, including foreclosure. If you have a judgment against you, your homestead property is protected from forced sale to satisfy the debt, except in certain cases such as mortgages, taxes, liens for improvements or repairs, obligations arising from divorce or child support, and judgment liens. It’s important to note that creditors, also known as judgment creditors, cannot take more than the value of your equity in the property. Homestead protection only applies to properties owned by natural persons, meaning entities such as trusts or corporations are not eligible for homestead protection. As a property owner, it is important to understand the basics of homestead protection and how it can protect you as a debtor, including the protection against levies on your homestead property.

How Homestead Laws Affect Property Sales

Selling a homestead property in Florida comes with certain considerations due to homestead laws. When you sell your homestead property, you may wonder how it will affect your homestead exemption and any potential tax liens. It’s important to understand that the sale of a homestead property does not automatically result in the loss of the homestead exemption under Florida law. However, there are specific steps you need to take to transfer the exemption to a new property. Additionally, any outstanding tax liens on the property should be addressed during the sale process to ensure a clear title transfer to the buyer.

Preparing Your Homestead Property for Sale

Preparing your homestead property for sale is essential to attract potential buyers and secure the best possible price. The real estate market in Florida can be competitive, so taking the time to stage your home and make essential repairs can make a significant difference in the selling process. Consider enhancing your property’s curb appeal, making necessary repairs, and decluttering to make it more appealing to buyers. A well-prepared homestead property can help you stand out in the market and attract potential buyers.

Essential Repairs and Improvements

When preparing your homestead property for sale, it’s important to focus on essential repairs and improvements that can increase its value and appeal to potential buyers. Here are some key areas to consider:

- Curb appeal: Enhancing the exterior of your property can create a positive first impression for potential buyers. Consider landscaping, painting, and repairing any visible damage.

- Home improvements: Updating outdated features, such as kitchens and bathrooms, can significantly increase your property’s value. Consider investing in energy-efficient upgrades or modernizing certain areas to attract buyers.

By focusing on essential repairs and improvements, you can maximize the value of your homestead property and make it more appealing to potential buyers.

Staging Your Home for Potential Buyers

Staging your home is an effective way to showcase its best features and create a welcoming ambiance for potential buyers. In the real estate market, first impressions matter, and a well-staged home can make a significant difference in attracting buyers. Consider the following tips when staging your homestead property:

- Declutter: Remove personal items and excess furniture to create a clean and spacious look.

- Neutralize: Use neutral colors and décor to appeal to a wider range of potential buyers.

- Highlight features: Emphasize the unique characteristics of your property, such as architectural details or outdoor spaces.

- Create a welcoming atmosphere: Use lighting, fresh flowers, and pleasant scents to create a warm and inviting ambiance.

By staging your homestead property, you can make it more appealing to potential buyers and increase its chances of selling quickly and at a favorable price.

Navigating the Market: When to Sell Your Homestead Property

Knowing when to sell your homestead property can significantly impact your selling experience. The Florida real estate market experiences fluctuations throughout the year, and understanding the selling seasons and market trends can help you make an informed decision. Generally, the spring and summer months are considered to be the peak selling seasons, as buyers are often more active during these times. However, market conditions and local factors can also influence the best time to sell. Analyzing market trends and consulting with a real estate agent can provide valuable insights into the optimal timing for selling your homestead property.

Analyzing the Florida Real Estate Market Trends

Analyzing the Florida real estate market trends can help you make an informed decision about when to sell your homestead property. Understanding market conditions, such as supply and demand, can give you insights into buyer preferences and pricing dynamics. Additionally, keeping an eye on real estate laws and regulations that may impact the market can help you stay ahead of any potential changes or challenges. Consulting with a real estate professional who specializes in the local market can provide valuable guidance and help you navigate the ever-changing landscape of the Florida real estate market.

Best Seasons to Sell Your Property in Florida

While the Florida real estate market can be active throughout the year, certain seasons tend to attract more buyer demand than others. The peak selling seasons in Florida are typically during the spring and summer months. This is when buyers are more active and motivated to purchase properties. However, it’s important to consider local market conditions and specific factors that may influence buyer demand in your area. By consulting with a real estate professional and analyzing market trends, you can determine the best time to sell your homestead property and maximize your chances of a successful sale.

Legal Considerations for Selling Homestead Property In Florida

When selling homestead property in Florida, there are several legal considerations that you need to be aware of. These considerations include mandatory disclosures, tax implications, and compliance with relevant Florida statutes. It’s important to understand your obligations as a seller and ensure that you provide all necessary disclosures to potential buyers. Additionally, understanding the tax implications of selling your homestead property can help you plan and minimize any potential tax liabilities. Consulting with a real estate attorney or agent who specializes in Florida real estate law can provide valuable guidance and ensure that you comply with all legal requirements throughout the selling process.

Mandatory Disclosures for Sellers in Florida

In Florida, sellers are required to provide certain mandatory disclosures to potential buyers. These disclosures are designed to ensure that buyers have all the necessary information about the property before making a purchase. The seller’s disclosure typically includes information about the property’s condition, known defects, and any material facts that may affect the buyer’s decision. It’s important to be thorough and honest when completing the seller’s disclosure to avoid any potential legal issues down the line. Consulting with a real estate attorney or agent can help you understand and fulfill your disclosure obligations as a seller in Florida.

Understanding Tax Implications for Sellers

Selling your homestead property in Florida can have tax implications that you need to consider. One of the main tax considerations is the potential capital gains tax on the sale. If you have owned the property for more than one year, you may be subject to capital gains tax on any profit you make from the sale. However, certain exemptions and deductions may apply, so it’s important to consult with a tax professional to understand your specific tax obligations. Additionally, property taxes may also need to be accounted for during the sale process. Understanding these tax implications can help you plan and make informed decisions when selling your homestead property.

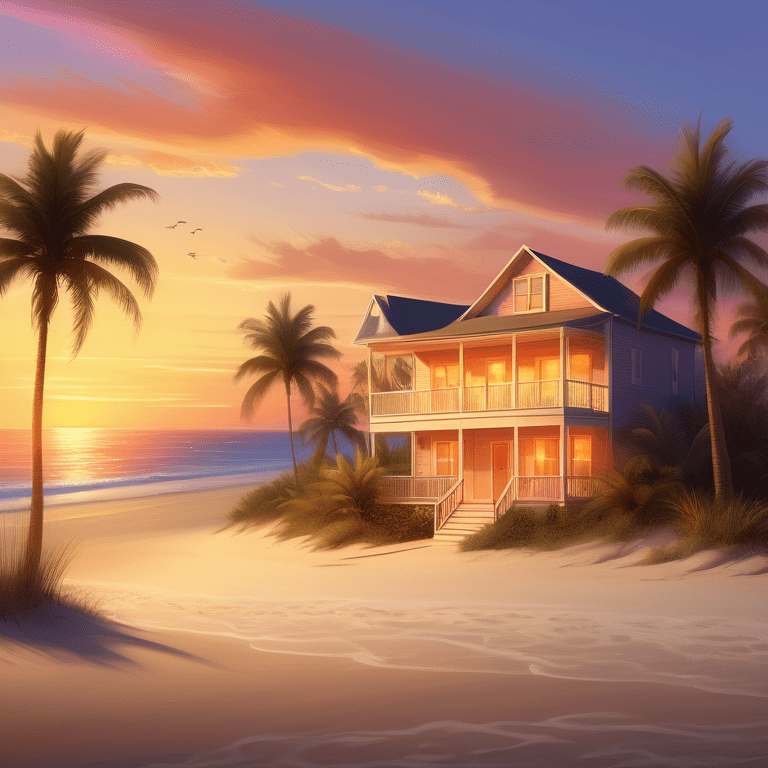

Marketing Strategies for Homestead Properties

Implementing effective marketing strategies is crucial when it comes to selling homestead properties. In today’s digital age, utilizing online platforms and digital marketing techniques can significantly broaden your reach and attract potential buyers. Creating an effective marketing plan that includes online listings, social media promotion, and targeted advertising can help showcase your homestead property to a wide audience. Additionally, leveraging local real estate networks and working with experienced real estate agents can provide valuable exposure and access to qualified buyers. By developing a comprehensive marketing strategy, you can increase the visibility of your homestead property and maximize your chances of a successful sale.

Digital Marketing Tips for Faster Sales

In today’s digital era, utilizing digital marketing strategies can significantly boost the visibility of your homestead property and attract potential buyers. Here are some effective digital marketing tips for faster sales:

- Online listings: Ensure that your homestead property is listed on popular real estate websites and platforms to reach a wide audience.

- Social media promotion: Utilize social media platforms to showcase your property through engaging posts, high-quality images, and virtual tours.

- Digital advertising: Consider targeted digital advertising campaigns to reach specific buyer demographics and increase the visibility of your homestead property.

- Professional photography: Invest in professional photography to showcase your property in the best possible light and attract potential buyers.

By implementing these digital marketing strategies, you can increase the exposure of your homestead property and attract qualified buyers, leading to faster and more successful sales.

Leveraging Local Real Estate Networks

Working with experienced real estate agents and leveraging local real estate networks can provide valuable exposure and access to qualified buyers. Real estate agents have in-depth knowledge of the local market and can help you navigate the selling process. They can also provide valuable insights into pricing, marketing strategies, and negotiation techniques for both residential and commercial real estate. Additionally, networking within the local real estate community can help you connect with potential buyers and expand your reach. By collaborating with real estate professionals and leveraging local networks, you can increase the visibility of your homestead property and maximize your chances of a successful sale.

Closing the Deal: Tips and Best Practices

Closing the deal on your homestead property requires careful attention to the closing process and best practices. Negotiating offers, managing paperwork, and ensuring a smooth transaction are essential. Here are some tips and best practices to consider:

- Negotiating offers: Carefully review offers, consider counteroffers, and negotiate the terms that best suit your needs.

- Managing paperwork: Stay organized and ensure all necessary paperwork is completed accurately and on time.

- Working with professionals: Collaborate with experienced professionals, such as real estate attorneys and title companies, to navigate the closing process.

- Communication: Maintain open and clear communication with all parties involved to facilitate a smooth closing.

By following these tips and best practices, you can navigate the closing process successfully and ensure a smooth transition of ownership for your homestead property.

Negotiating Offers on Your Homestead Property

Negotiating offers on your homestead property is a crucial step in the selling process. Carefully reviewing offers and considering counteroffers can help you achieve a favorable outcome. Here are some tips for negotiating offers:

- Evaluate the buyer’s offer: Consider the price, terms, and contingencies outlined in the buyer’s offer.

- Understand your priorities: Determine your priorities and what terms are most important to you.

- Consider a counteroffer: If the buyer’s offer does not meet your expectations, consider making a counteroffer with revised terms.

- Maintain open communication: Maintain open and clear communication with the buyer’s agent to ensure a smooth negotiation process.

By negotiating offers effectively, you can secure the best possible deal for your homestead property and ensure a successful sale.

The Closing Process in Florida Explained

The closing process is the final step in selling your homestead property in Florida. It involves the transfer of ownership, payment of closing costs, and the completion of all necessary paperwork. Here is an overview of the closing process:

- Initial agreement: Once you have accepted an offer, a purchase agreement is signed by both parties.

- Title search and insurance: A title search is conducted to ensure that the property has a clear title, and title insurance is obtained to protect against any potential title issues.

- Closing costs: Closing costs, which include fees for services such as title insurance, appraisal, and lender fees, are paid by both the buyer and the seller.

- Final walkthrough: The buyer has the opportunity to inspect the property one final time before the closing.

- Signing the documents: Both parties sign the necessary documents, including the deed and other closing documents.

- Funds transfer: The buyer provides the funds for the purchase, and the seller receives the proceeds from the sale.

- Title transfer: The title is transferred to the buyer, and the deed is recorded with the appropriate county office.

By understanding the closing process and working with experienced professionals, you can ensure a smooth and successful closing for your homestead property.

Post-Sale Considerations

After selling your homestead property, there are several post-sale considerations to keep in mind. These considerations include investing the sale proceeds, planning for relocation if necessary, and overall financial planning. Here are some key points to consider:

- Investing sale proceeds: Consult with a financial advisor to make wise investment decisions with the proceeds from the sale.

- Relocation: If you are planning to relocate, consider the costs and logistics involved and plan accordingly.

- Financial planning: Take the opportunity to review your overall financial situation and goals, ensuring that the sale of your homestead property aligns with your long-term plans.

By addressing these post-sale considerations, you can make informed decisions and optimize the outcomes of selling your homestead property.

Investing Proceeds from the Sale Wisely

Investing the proceeds from the sale of your homestead property requires careful consideration and planning. Here are some strategies to consider:

- Consult with a financial advisor: Seek advice from a financial advisor who can provide guidance based on your specific financial goals and risk tolerance.

- Diversify your investments: Consider spreading your investments across different asset classes to minimize risk.

- Plan for the long term: Determine your investment horizon and align your investment strategy accordingly.

- Regularly review and adjust: Keep track of your investments and regularly review your portfolio to ensure it remains aligned with your goals.

Working with a financial advisor can help you make informed investment decisions and ensure that the proceeds from the sale of your homestead property are managed wisely.

Relocating After Selling Your Homestead Property

If you are planning to relocate after selling your homestead property, there are factors to consider. These include:

- Moving costs: Take into account the costs associated with hiring movers, packing supplies, and transportation to your new residence.

- Finding a new residence: Begin your search for a new residence in your desired location and consider factors such as proximity to amenities, affordability, and lifestyle preferences.

- Change of address: Update your address with relevant institutions such as banks, credit card companies, and government agencies.

Planning ahead and staying organized can help ensure a smooth transition to your new residence and minimize any potential disruptions.

Conclusion

In conclusion, selling homestead property in Florida requires a strategic approach encompassing legal knowledge, market analysis, and effective marketing tactics. Understanding the nuances of Florida homestead laws, preparing your property for sale, and navigating the real estate market trends are pivotal steps in ensuring a successful transaction. From essential repairs to post-sale considerations, each stage demands attention to detail and expertise. To streamline the process and maximize your returns, seek professional guidance and leverage industry insights. If you’re ready to embark on this journey, get in touch with our experts for personalized assistance.

Frequently Asked Questions

What qualifies as a homestead property in Florida?

In Florida, a homestead property is defined as your primary residence, whether it is a house, condo, mobile home, or boat. It must be your permanent home, not exceed half an acre in a municipality, or 160 acres outside a municipality. Homestead properties are eligible for homestead exemption benefits.

Can I sell my homestead property without losing my exemption?

Yes, you can sell your homestead property without losing your exemption. However, you need to follow specific procedures to transfer the exemption to a new property. It’s important to consult with a real estate attorney or agent to ensure that you comply with Florida statutes and maintain your eligibility for the homestead exemption.

How does the homestead exemption affect my property taxes?

The homestead exemption reduces the taxable value of your property by up to $50,000, leading to lower property taxes. The exact impact on your tax bill will depend on the assessed value of your property and the tax rate set by the county property appraiser. It’s important to consult with your local tax authority for specific details.

What are the steps to transfer homestead exemption after sale?

To transfer the homestead exemption after the sale, you need to file a new application with the county property appraiser within a specific timeframe. You will need to provide documentation such as a deed or title for the new property and a declaration of domicile. Specific requirements may vary, so it’s essential to consult with the county property appraiser or a real estate attorney for detailed instructions.