Suppose you’re serving as a personal representative in Florida, tasked with managing the affairs of a deceased individual. In that case, you might wonder, “Can a personal representative sell homestead property in Florida?” At EPS Houses, we’re here to provide clarity on this topic. Selling homestead property as a personal representative is indeed possible, but the process involves navigating specific legal considerations. In this blog post, we’ll delve into the intricacies of selling homestead property in Florida as a personal representative, shedding light on the steps, requirements, and potential challenges you may encounter.

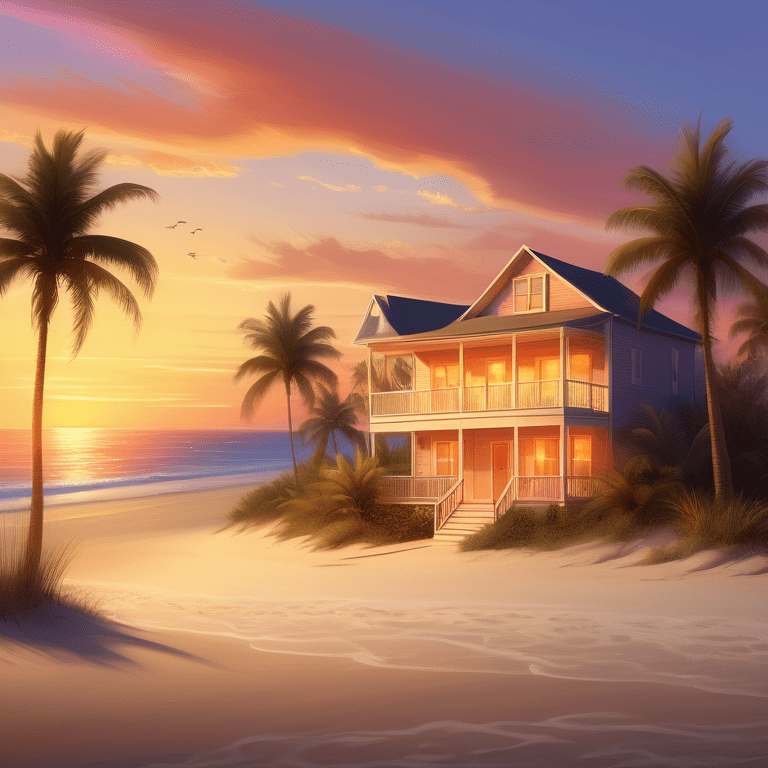

Understanding Homestead Property in Florida

Homestead property is uniquely legal in Florida, offering homeowners various protections and benefits. Often the primary residence, a homestead, comes with exemptions that reduce property taxes and offer creditor protection.

Selling Homestead Property as a Personal Representative

As a personal representative, you possess the authority to sell homestead property. However, this authority comes with specific legal guidelines and steps:

1. Seek Court Approval

Your first step is to obtain court approval. This entails filing a petition with the probate court, outlining the reasons for the sale, and providing an overview of the proposed terms. The court’s role is to ensure the sale aligns with the estate’s best interests and the beneficiaries.

2. Honor Beneficiary Consent

If the decedent’s will contains directives regarding the property’s sale, adhere to those instructions. Without specific guidance, seeking the beneficiaries’ consent helps streamline the process.

3. Establish Fair Market Value

Determining the homestead property’s fair market value is crucial. Obtain a professional appraisal or consult a real estate agent to assess its value and ensure competitive pricing accurately.

4. Develop a Comprehensive Marketing Plan

Creating a dynamic marketing strategy is essential to attract potential buyers. Collaborate with an experienced real estate agent, particularly one well-versed in probate sales, to develop a plan that complies with legal requirements.

5. Verify Buyer Qualifications

Verify potential buyers’ financial qualifications before proceeding. Ensuring their capacity to purchase helps avoid complications later on.

6. Obtain Court Confirmation of Sale

Once a suitable buyer is found, the sale must receive court confirmation. This involves presenting the offer’s terms to the court for approval before proceeding with the closing process.

7. Distribution of Proceeds

After finalizing the sale, the proceeds typically go toward settling any outstanding estate debts. The remaining funds are distributed to beneficiaries following the will or court directives.

Conclusion

While selling homestead property in Florida as a personal representative involves legal complexities, EPS Houses is here to guide you through the process. You can fulfill your responsibilities smoothly by understanding and adhering to legal requirements and seeking professional advice from probate attorneys and real estate experts at EPS Houses. At EPS Houses, we’re dedicated to supporting you to navigate this intricate journey successfully.